Innovating Digital Finance Solutions

We are committed to creating products and services that assist individuals & institutions in adopting digital assets and innovating within the increasingly digital world of finance.

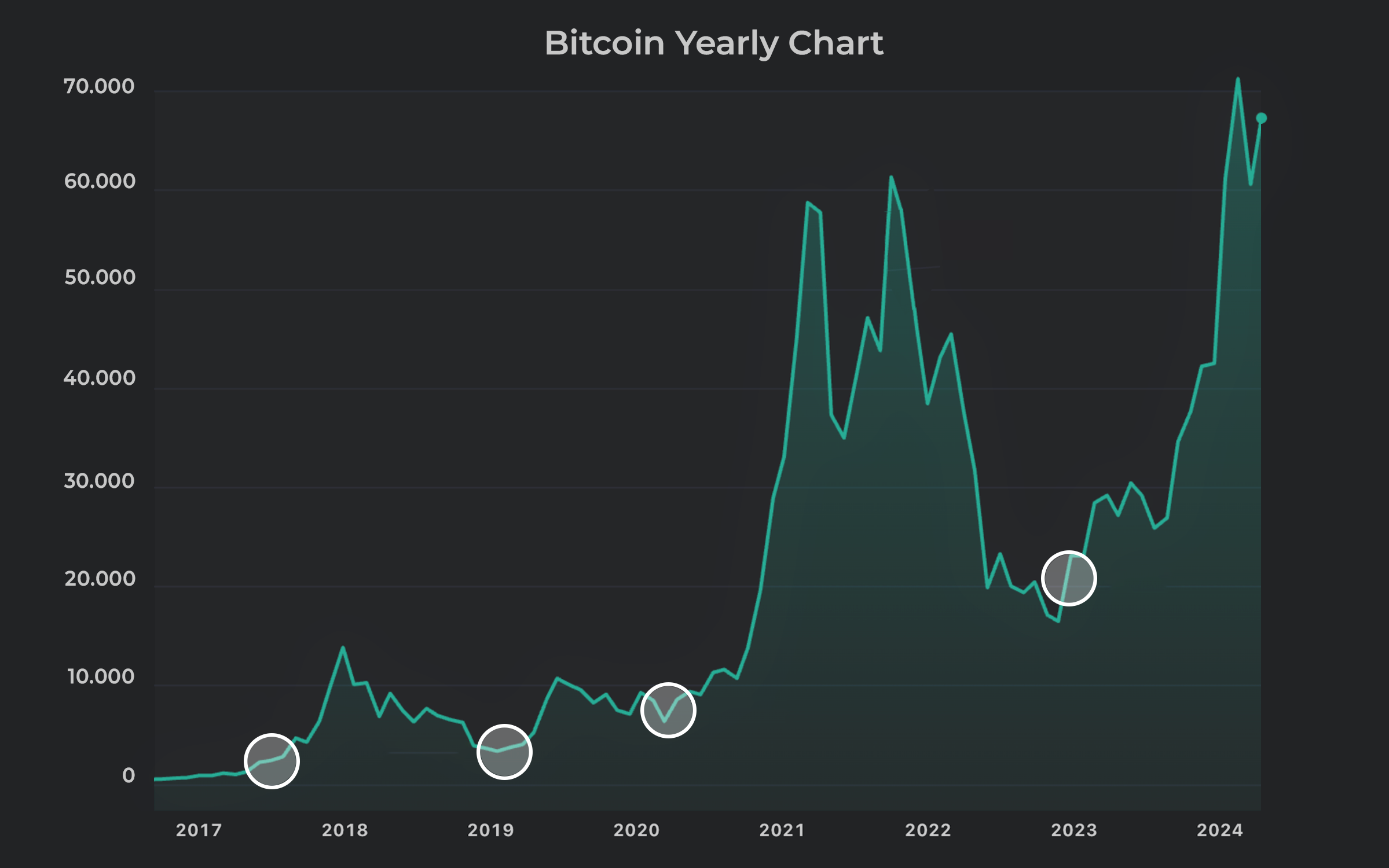

Our digital assets portfolio has generated an average return of 300-500%* over a 4-year period for our professional investors.

*based on historical data.

‘Sardar Capital: Digital Assets’ is a subsidiary of Sardar Capital Asset & Investment Management and operates as a separate business dedicated to digital assets.

Tailored Digital Asset Solutions for Every Investor.

Our digital asset platform and investment solutions are designed to meet the unique and diverse needs of individual and institutional investors.

We believe that digital assets are a key pillar in the future of investing.

We have been early adopters of blockchain technology and digital assets solutions dating back to 2016, leading to the current establishment of Sardar Capital Digital Assets.

Our extensive research and development has provided us with the expertise necessary to educate our clients and overcome the obstacles of investing in the digital asset market.

We are providing a reliable gateway for investors looking to gain exposure to digital assets. We offer custom solutions for institutional and retail investors, supporting their long-term financial goals.

Why choose Us?

Investor-Centric Approach

At Sardar Capital Digital Assets, investors come first. Our priority is crafting crypto investment strategies tailored to each client’s specific needs, risk tolerance, and preferences.

Customized Strategies

We personalize crypto investment strategies to suit individual investors, ensuring alignment with their unique financial goals and objectives.

Trusted Solutions

Our commitment to providing high-quality and trusted crypto investment solutions ensures that investors can rely on us for secure and reliable investment opportunities in the digital asset space.

Timely Market Insights

With Sardar Capital Digital Assets, investors receive timely market insights to stay informed and make informed decisions, helping them navigate the dynamic and ever-evolving crypto market landscape.

How We Invest

Strategically and meticulously.

Cycle-Centric Investment Strategy

Our primary investment strategy is based on Bitcoin’s four-year halving process, which determines the market cycle for the entire asset class. We aim to buy and sell at the optimal phases of the cycle, maximising returns for our clients.

Our Approach

We believe that a methodical approach to evaluating digital assets is crucial. Digital assets demands meticulous due diligence, careful consideration and a strategy that integrates conventional traditional asset assessment with a progressive outlook on the evolution of this emerging asset class.

Data-Driven Investing

Our investment process focuses on selecting best-in-class digital assets, guided by a fundamental research framework that leverages our proprietary tokenomics scorecard. We complement this with quantitative tools and qualitative insights drawn from decades of experience in capital and regulatory markets, ensuring informed decision-making and robust results for our clients.

Digital assets make up a diverse ecosystem that can provide risk-tolerant investors with the opportunity to achieve higher returns in a growing asset class. The rapid expansion of digital assets has the potential to influence the investment landscape, with a market capitalization of $1.5 trillion and an average of 5.9 million daily users.

Capital is at risk